March 2007 – A Picture is Worth a Thousand Words

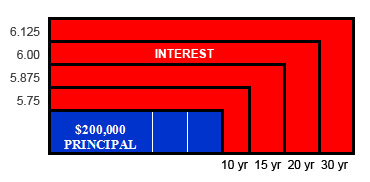

wotofo profile v1 5 24mm rdaEveryone has heard that statement before, but how many of you have seen my picture. Not a picture of me, but a picture that hopefully will amaze you in a way that you will finally make the move to a shorter term mortgage. Enough said; take a look and see for yourself.

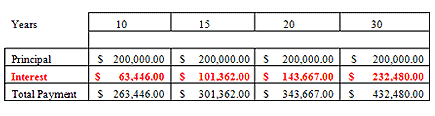

Now that you see it do you believe it? It is pretty obvious that any loan is pretty good up to the 20 year amortization but after that you are simply overpaying interest to keep a loan going that doesnÂ’t need to continue. While the 10 year fixed is clearly the least expensive way to finance your house the, 15 and 20 year loans are good alternatives for those who cannot afford the 10 year payment. There simply isnÂ’t a good reason to opt for the 30 year except for very specific reasons which do not apply to the average borrower.

The monthly payments on the various loans referenced above are $2192 for the 10 year, $1671 for the 15 year loan, $1429 for the 20 year and $1211 for the 30 year loan. A quick look at the value of each loan in relation to the 30 year is as follows: The 10 year pays off in 1/3 of the time of the 30 year loan but doesnÂ’t cost even twice as much! The 15 year pays off twice as fast as the 30 year but only costs about 1/3 more. The 20 year loan takes only 2/3 of the time to finish but only costs 18% more than the 30 year on a monthly basis. All of these examples show that the value to the borrower is not in the 30 year loan, but in every other loan.

The question now is how do you get into a shorter amortizing loan if your budget is already stretched to the maximum? One of the ways is to break it down to a daily cost. It wonÂ’t be pennies but it also wonÂ’t be that many dollars to go from a 30 year to one of the other choices. To go to a 10 year it will cost about $33 a day more, a 15 year will be approximately $15 a day (more manageable) and a 20 year will be the easiest at $7.25 a day. If you can find those types of dollars in your budget then you can save yourself a fortune! Your savings without interest accumulating will be as follows:

10 year will save 20 years of payments of $1211 a month = $290,640

15 year will save 15 years of payments of $1211 a month = $217,980

20 year will save 10 years of payments of $1211 a month = $145,320

($1,211.00 is the 30 year monthly payment)

These numbers can make the above sacrifice worthwhile. You can look at it as a weekend problem and notice that to get to a 10 year loan from a 30 year you would have to save about $245 a weekend, which might be more than you are currently spending. A 15 year loan would have a savings requirement of $115 a weekend which is still a monumental task for some. The 20 year loan only requires about $55 a weekend to be cut from your budget, which is certainly more feasible.

The actual savings above will only occur if you a comparing taking one of the other loans versus a 30 year. Most people will have been in their 30 year a few years before awaking to their financial situation and start thinking about the refinancing to a shorter term loan. Therefore the savings would be less.

There are many other ways but I would like to suggest the one that makes the most sense to me because it is a double win. If we assume you have credit cards of $20,000 and your monthly minimum payment is $400 which includes 1% of the balance as a principal reduction and carries 12% interest (low in this market) and you continue to pay the minimum until the balance is gone it will take you at least 8 years to finish, albeit the payment amount would average about $200 a month over the 8 years. Can you see the wisdom of rolling the credit card into a new 15 or 20 year mortgage and save most of the large sums listed above? I believe it is certainly worth considering.

This exercise is primarily to show you the enormous cost and waste of a very rare resource, your money. I hope the picture of all the red ink above will make you understand the unattractiveness, financially speaking, of the 30 year loan.