Click Here to listen to an Important Message from Roger >>>

ARE YOU TIRED OF THROWING YOUR MONEY DOWN THE DRAIN?????

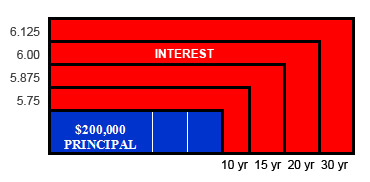

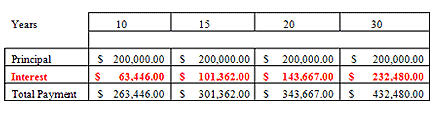

A Picture is Worth a Thousand WordsEveryone has heard that statement before, but how many of you have seen my picture. Not a picture of me, but a picture that hopefully will amaze you in a way that you will finally make the move to a shorter term mortgage. Enough said; take a look and see for yourself.

I’m Roger Schlesinger, host of the “Mortgage Minute” and President of Manhattan West Mortgage, and if these statistics are news to you, you are not alone!!!! I’ve spent the last 30 years exploring the complicated financial markets in order to enlighten and educate both my listening audience and my clients while guiding them along their own unique road to financial freedom.

In working with thousands of people, I have found that the most important aspect of assisting someone into financial freedom is to educate them on all the options available to them and the advantages to each. Not only have I found that most of my clients do not realize they have options, they are completely frustrated by their lack of mortgage vernacular. I have made it my life’s work to educate the public on the options available to them so that they might rest a little more peacefully-knowing their money is well-placed and growing for them.

One Thing I Know For Sure.

Whether you are a first time home buyer, have credit or debt issues, or consider yourself a seasoned real-estate “pro”, your potential economic future should be the one dictating force behind acquiring a new mortgage. Therefore, it’s imperative that you know where you’re going so you don’t end up where you just might be heading!

Variable or Fixed-What’s For Me????

Should I take a variable rate loan, a fixed rate loan or a hybrid? (Not even your mother knows you that well!) To determine what you need, want or desire you must try to answer the following questions:

- How long will I be in the property?

- What is my earning potential over that period of time?

- How much do I have in cash reserves?

Once you have a clear picture as to the direction in which you wish to head, you need to analyze your personality. Can you live (and/ or sleep) with a variable loan or a short-term fixed that becomes variable? While it may be your comfort level that decides, there are some important things you should know!

30 Years is a Jail Sentence-Not A Loan Term!

So now that you know that it takes approximately 21 years to pay off just half of a 30 year loan, you may also be interested in knowing that during that time you could have completely paid off a 15 year or a 20 year fixed while saving hundreds of $1000’s of dollars!!!

Whether you are interested in paying off your house or not, you should be interested in saving money!! If you take one of the plans that I have mentioned above and start paying yourself instead when the mortgage is finished, you will have saved at least 2 times the amount of your first mortgage in a 10 year plan, 1.5 times the amount of your first mortgage in a 15 year plan, and double your money with a 20 year plan while your friends are still paying their 30 year fixed.

This is simply a maximization of your disposable income.

Do You Realize You Are Sleeping On a Fortune???

| “Everyone has, I think, in some quiet corner of his mind, an ideal home waiting to become a reality.”-Paige Rense, Editor, Architectural Digest |

An alternative instead of accumulating the money would be to use that money to purchase other homes and increase your opportunity to create more wealth with your next home. If you are considering your first home purchase, you should know that owning a home is an excellent start to solving a lot of your financial problems, and I have always recommended taking the plunge! Once you have accumulated this valuable asset, you can begin to use it towards reaching your ultimate goal-Financial Freedom!!

After All, when it comes to dollars, it’s not what you make-it’s what you keep and how you use what you keep!

That being said, we have found that many of our clients focus on their loans being fixed for 30 years for security reasons while they could be saving thousands of dollars by considering their other options.

The last client I worked with who said their house was sacrosanct finally succumbed to a variable four years ago and paid off more of their loan in the last four years than they did in the last 10 years in their 30 year fixed!!! They saved all of that while cutting their payments in half. While they were ecstatic at the results, they did it because they had to, not because they wanted to?.

The Most Misleading Concept in the Mortgage Industry.

With the advent of the internet and the posting of interest rates on Web Sites, Billboards, and anywhere else there is vacant air space, borrowers have become more inundated with mortgage information than at any other time in history. Now that people are privy to interest rates, they are ready to act and cut out what mortgage experts have been reputed to be: “The Costly Middle-men”.

In a perfect world where all borrowers were the same, all properties were equal, and all loans were equivalent to each other, that might be a feasible solution.

However, a borrower is a composite of a credit score, liquid assets, and monthly earnings. A property is a composite of its size, type, land, condition and neighborhood. A loan needs to incorporate and be compatible with ALL the conditions.

Rates alone do not serve a borrower in every case because of the aforementioned variable, and knowing some of those rates does not insure the best loan at the lowest interest and least cost for the borrower.

Freely Translated, Most People Who Attempt To Find Financing on Their Own Do Not Do as Well as Those Who Use An Expert.

In fact, not only can it end up costing them thousands of dollars in up-front costs but tragically and unnecessarily, it can end up costing them tens of thousands of dollars in the long run.

It’s like reading about a great restaurant dish on the internet, then going home and trying to cook it. Sure, it may taste okay, but you’ve missed out on the real flavor if you don’t have the right cook!

You Don’t Go To The Doctor and Tell Him What’s Wrong and What You Need To Have Done. Therefore, please allow us to diagnose your financial condition and make our recommendations on how to give you a better financial future.

Almost Anything You Think We Can’t Do…..

I Know From Experience That We Can Do!!!!!

We are in the Business of Helping People!

Are you ready to get started??

Click here to fill out our short form loan application so we can connect you with a member of our team of mortgage professionals on your own unique road to financial freedom.

We sincerely look forward to the opportunity to serve you,

Roger Schlesinger

“The Mortgage Minute Guy”

Copyright 2006 Roger Schlesinger. All Rights Reserved.

The Mortgage Minute Guy

15300 Ventura Blvd. #303

Sherman Oaks, Ca 91403

(866) 304 9378